Nokia - Aims for greater share of fixed-mobile convergence market

-

Over the years, with the telecom segment's growth rate accelerating, Nokia has been able to cash in. But the race is far from over.

Having captured a sizeable lead in its handsets division, Nokia has set its sights on boosting its networks segment. In June 2006, the company announced its decision to merge its networks division with that of Siemens.

The deal is the latest in a wave of consolidation that began when Ericsson agreed to buy Marconi's broadband internet and telecommunications assets for –£1.2 billion.Similarly, Alcatel launched a $13.4 billion stock swap to acquire Lucent.

The Nokia-Siemens joint venture, christened Nokia Siemens Networks, is one of the world's largest telecom equipment manufacturers. The tie-up, due to be completed by March 2007, makes good business sense for both companies.

Globally, the joint venture will be the second largest company in mobile infrastructure and services. In the fixed infrastructure segment and the overall telecommunications infrastructure market, it will be third largest.

According to Nokia, the two companies are expected to generate combined annual revenues and synergies of $20 billion and $1.9 billion respectively.

Through the merger, Nokia, which is strong in the wireless segment, will gain access to Siemens' fixed line telecommunications business. The company stands to gain considerably from Siemens' experience in the fixed line segment, while Siemens will benefit from Nokia's management expertise. Both companies can then go on to become bigger fish in the fixed-mobile convergence market.

Industry watchers have reacted favourably to the merger. According to Sourabh Kaushal, industry manager, ICT Practice, Frost & Sullivan, India: "Nokia is very strong in the wireless segment, and is known for it." However, there is still room for greater focus on its other segments.

The plan is for the Nokia-Siemens combine to take on Ericsson and the Alcatel-Lucent combine. It will also be in a better position to fend off mounting assaults from low-cost Chinese manufacturers.

The merged entity's proposed portfolio plan covers the six future business units: radio access, service core and applications, operation support systems, broadband access, IP transport and services. It will also offer quadruple-play services, comprising TV, broadband access, fixed and mobile telecommunications.

In India, the Nokia-Siemens combine will additionally focus on low-cost solutions for GSM and a combination of WiMax solutions for the rural areas.

Although no money has changed hands in the 50:50 deal, Siemens, which was holding on to a losing telecommunications business, had to offer a discount to Nokia, which runs a profitable network equipment business.

Consequently, Siemens will contribute $11.57 billion worth of revenues to the new business while Nokia accounts for $8.3 billion.

Recent contracts

The strength of the new entity will soon be tested with Nokia recently emerging as the second lowest bidder for Bharat Sanchar Nigam Limited (BSNL)'s 45.5 million GSM line contract.

The design of the BSNL tender is such that the lowest bidder, Ericsson, gets 60 per cent of the contract, while the second lowest, Nokia, gets the balance at the price offered by the lowest bidder. According to reports, Ericsson had bid $107 a line, while Nokia had bid $177 a line.

Though the final award of the contract has been postponed by the court due to BSNL's altercation with Motorola, BSNL has in the meantime awarded a 4 million line cellular contract to Nortel, Ericsson and Nokia at an estimated cost of $250 million. This is according to the tender conditions which state that BSNL can give additional orders of up to 20 percent to the existing vendors without going for a rebid.

Nokia phones to be released in 2007

Nokia E61i: Designed for internet lovers. Its features include dedicated e-mail keys, nav key, a large screen, and QWERTY keyboard. Other features include MP3 player and a 2 megapixel (MP) camera.

Nokia E90 Communicator: Advanced business device with HSDPA. It also has integrated GPS to navigate through cities with directions.

Nokia E65: Provides 3G mobile broadband connections. Users can open and edit documents on the move. Phone also features quad-band GSM global roaming.

Nokia 6300: 2 MP camera with 8x digital zoom, music player, video player and up to 2GB expandable memory Nokia N77: Live mobile TV, with digital music player and high quality stereo speakers. It can also alert the user when his/her favourite programme is starting and show programme guides up to seven days.

Nokia N95: Mobile convergence device which includes integrated GPS, a 5 megapixel camera, digital music player, full PIM functionality, support for high speed wireless networks, and maps.

In June 2006, Hutchison Essar signed a multi-million dollar deal with Nokia for outsourcing its cellular infrastructure requirements across 10 circles. Nokia will manage and roll out the mobile network on behalf of Hutch, including the supply of infrastructure equipment.Nokia will run 19 of the operator's 23 circles. The new agreement for managing 10 circles is in addition to the nine-circle contract awarded by Hutchison Essar earlier this year. Of the 10 new circles that Nokia has won, seven are greenfield operations.

Outsourcing network management to equipment providers is a new trend that Indian operators have taken up enthusiastically. In November 2006, Bharti Airtel awarded Nokia an estimated $400 million contract to expand its managed GSM/GPRS/EDGE networks in eight of its circles and deploy a pan-Indian WAP solution across its networks. Under this three-year contract, Nokia will provide managed services and expand Airtel's networks to cover all towns and cities in the eight telecom circles of Mumbai, Maharashtra and Goa, Gujarat, Bihar (including Jharkhand), Orissa, Kolkata, West Bengal and Madhya Pradesh (including Chhattisgarh).

In the past two years, Nokia has signed two contracts with Bharti Airtel, collectively worth $400 million, for the supply of equipment and managed services.Reports also say that it is negotiating with Bharti for a 60 million line contract.

With close to 60 managed service contracts globally, Nokia is a leading player in the managed services business.It has recently built up its presence in India and provides managed services in 27 telecom circles.

Handsets

While the company gears up to become the leading supplier of network equipment and managed services to all major GSM operators, it is the undisputed leader in the handsets business.

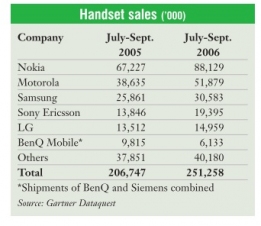

According to Gartner, in the July to September 2006 quarter, Nokia sold around 88.1 million handsets, with approximately 20.9 million units supplied in the Asia-Pacific region. This amounts to approximately 35.1 per cent market share of the global handset market, up from 32.5 per cent in the corresponding period of the previous year. Nokia reportedly expects to unveil more than 30 new devices in 2007.

The company sells around 6 million mobile phones every month in India.

However, the GSM handset market is growing at such a scorching pace that even with a 100 per cent growth in volumes Nokia has seen a dip in market share in the past one year, despite being the market leader. According to ORG-GFK figures, Nokia's share in the GSM handset market has come down from the heights of 78-80 per cent in end-December 2005 to around 70 per cent at the end of December 2006.

In the same period, Motorola's market share has risen from 5 per cent to 15 per cent while Sony Ericsson has acquired around 8 per cent market share.

However, according to analysts, there is no cause for concern for Nokia. According to Kaushal, "Nokia is very solid on low-end phones. For a while, perhaps, Sony Ericsson was encroaching on its market share with its high-end phones. However, now Nokia has again come back with its N series and E series high-end phones."

In fact, aided by a boost in demand for its cellphones in India and China, Nokia has posted a 19 per cent year-on-year jump in fourth quarter earnings globally.The company's net profits for the October to December 2006 quarter also rose from $1.38 billion to $1.65 billion in the corresponding quarter of the previous year.

During the period under review, its revenues increased by 13.1 per cent from $13.3 billion to $15.1 billion.

The road ahead

With India's telecom market showing no signs of levelling off, at least not for another two years or so, Nokia is here to stay. India is the third largest market for Nokia in volume terms, according to Devinder Kishore, director, marketing, Nokia India.

"We are extremely buoyant about the market given the tremendous growth that the industry is witnessing, with an average net addition of 6 million new subscribers every month," says Jukka Lehtela, director operations, Nokia, India.

The company also believes that there is a huge, untapped opportunity to showcase the productivity benefits of mobile telephony to the rural masses.

In the future, Nokia aims to ensure that telecom services reach the rural and semi-urban regions in the country. As Kishore puts it, Nokia's strategy is to create awareness, availability and affordability for mobility. With its strategy solidly in place, the company is well on its way to spur mass-scale adoption.

Suparna Dasgupta

Nokia-Siemens Networks' combined entity

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Brand Idea: Focus on 3G, rural areas and...

- Samsung Mobiles: Smartphone strategy for...

- BSNL: Exploring revival strategies

- Reliance Jio Infocomm: Set to change the...

- Reliance Infotel: Strongly placed to tap...

- Tulip Telecom: On a sticky financial wic...

- MTNL: Survival strategies

- Bharat Sanchar Nigam Limited: Attempts t...

- Aircel: Increasing its footprint

- Vodafone India: Growth despite regulator...